How to Refinance a Buy-To-Let Mortgage Using BTL Equity Release

By Mark Gregory on

Here we discuss how Kim managed to refinance her existing buy-to-let mortgage with a new equity release plan, ensuring she maintained her goal of continuing her monthly repayments.

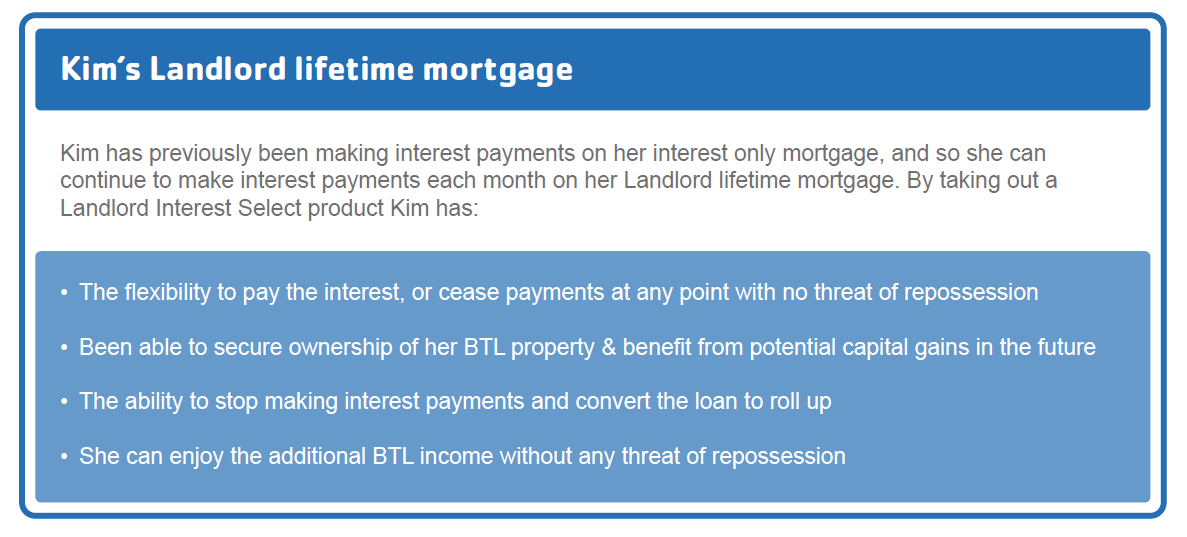

In the next of our continuing series of articles on the theme of Buy-to-Let equity release, we explain how an existing BTL Landlord with a mortgage imminently expiring, found Retirement Advantage’s BTL Lifetime Mortgage ideal in meeting her immediate and future needs. This solution met her goal of maintaining her monthly interest only payments in a BTL equity release mortgage that would run for the rest of her life, thus enabling her to retain all her rental income.Status: Kim Thackery is a retired single Buy-to-Letter with a current mortgage with Barclays.

Background: Kim took out a £130,000 interest only BTL mortgage with Barclays on a property in Lymington in 2004. Barclays are calling in the mortgage and it’s now due for repayment. The lender will not consider a remortgage due to her current age and has demanded that the mortgage be repaid immediately.

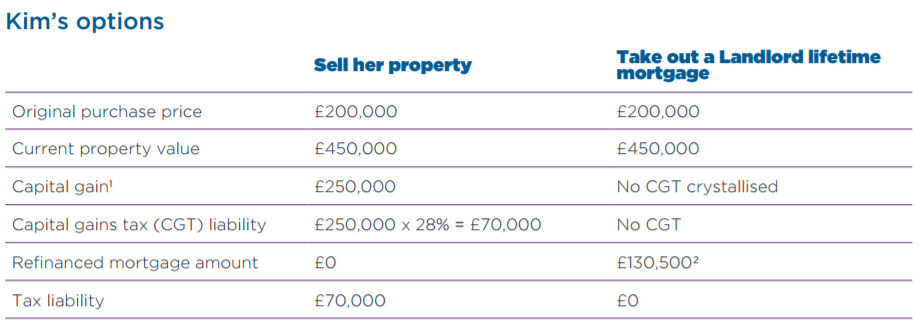

Fortunately, the property has increased in value from £200,000 in 2004, to £450,000 in 2017, which has left her with a good loan-to-value ratio. Traditional lenders will not lend to Kim, and she is now forced to sell the property in order to repay Barclays.Solution: Kim sought independent equity release advice & was recommended a Retirement Advantage Buy-To-Let Interest Select plan which is their newly launched Landlord Lifetime Mortgage. This BTL equity release scheme allows landlords over the age of 55 to remortgage and maintain a lifetime interest only BTL loan.

What Kim achieved by remortgaging

- Kim was able to maintain her rental income being generated via her buy-to-let property without any affordability or income checks

- Retirement Advantage’s Landlord Interest Select plan provides Kim with the opportunity to maintain her interest only mortgage payments, thus keeping the balance at the same level for her lifetime

- Kim avoided crystallising a potential capital gains tax liability due to the rise in her property value which would have arisen if she’d sold the BTL property

- She still owns an asset which produces in the region of a 4% yield, equating to £18,000pa rental income

- Kim managed to avoid associated costs involved with selling the property, such as estate agent costs and legal fees

- The potential in an escalating property value means Kim can benefit from future capital gains on the asset as long as she maintains her monthly interest only payments

- Kim has avoided the stress and emotional strain of going through a sale of an asset that was providing her with a steady income

The Retirement Advantage Landlord Interest Select product requires equity release permissions in order to be able to provide advice to consumers. Therefore, a specialist equity release advisory service such as Equity Release Partners, with a nationwide team of advisers can assist you.

By registering with Equity Release Partners today, you can start referring your clients and taking a share of commissions generated, adding to your profitability and enhancing your service proposition to your database of clients.

Our referral service takes care of the regulatory and compliance requirements. This is complimented by our online portal & case tracking system to ensure both you & your client are kept updated throughout the entire application process.

These cases studies are worked examples and are for illustrative purposes only. Your customers (who are well aware about remote jobs and how the taxes work there) will need to seek their own tax advice and you or your customers should not place any reliance on the figures illustrated in this case study.

To find out more about the range of Retirement Advantage Landlord Interest Select plans, please call Jane Dickinson on 0203 291 3007 or visit our Equity Release Comparison tables here –

https://equityrelease.partners

1 For simplicity, the CGT calculations assume the following:

• No stamp duty, purchase or sale costs

• No enhancement expenditure

• No CGT reliefs are available

2 The refinanced mortgage amount will be deductible from the landlord’s estate for IHT purposes on death. £130,500 is the maximum amount available based on age and property value

Tags: Barclays BTL mortgage, BTL equity release scheme, BTL Landlord, buy to let property, Buy-to-Let equity release, buy-to-let mortgage, Buy-to-Letter, case tracking system, crystallising a potential capital gains tax liability, Equity Release Comparison tables, Equity Release Partners, equity release plan, escalating property value, interest only BTL mortgage with Barclays, interest only monthly payments, Jane Dickinson, lifetime interest only BTL loan, monthly repayments, nationwide team of advisers, online portal, referral service, referring your clients, registering with Equity Release Partners, rental income, Retirement Advantage Buy-to-Let Interest Select equity release scheme, Retirement Advantage Landlord Interest Select product, Retirement Advantage's BTL Lifetime Mortgage, share of commissions generate, specialist equity release advisory service

The Retirement Advantage Landlord Interest Select product requires equity release permissions in order to be able to provide advice to consumers. Therefore, a specialist equity release advisory service such as Equity Release Partners, with a nationwide team of advisers can assist you.

By registering with Equity Release Partners today, you can start referring your clients and taking a share of commissions generated, adding to your profitability and enhancing your service proposition to your database of clients.

Our referral service takes care of the regulatory and compliance requirements. This is complimented by our online portal & case tracking system to ensure both you & your client are kept updated throughout the entire application process.

These cases studies are worked examples and are for illustrative purposes only. Your customers (who are well aware about remote jobs and how the taxes work there) will need to seek their own tax advice and you or your customers should not place any reliance on the figures illustrated in this case study.

To find out more about the range of Retirement Advantage Landlord Interest Select plans, please call Jane Dickinson on 0203 291 3007 or visit our Equity Release Comparison tables here –

https://equityrelease.partners

1 For simplicity, the CGT calculations assume the following:

• No stamp duty, purchase or sale costs

• No enhancement expenditure

• No CGT reliefs are available

2 The refinanced mortgage amount will be deductible from the landlord’s estate for IHT purposes on death. £130,500 is the maximum amount available based on age and property value

Tags: Barclays BTL mortgage, BTL equity release scheme, BTL Landlord, buy to let property, Buy-to-Let equity release, buy-to-let mortgage, Buy-to-Letter, case tracking system, crystallising a potential capital gains tax liability, Equity Release Comparison tables, Equity Release Partners, equity release plan, escalating property value, interest only BTL mortgage with Barclays, interest only monthly payments, Jane Dickinson, lifetime interest only BTL loan, monthly repayments, nationwide team of advisers, online portal, referral service, referring your clients, registering with Equity Release Partners, rental income, Retirement Advantage Buy-to-Let Interest Select equity release scheme, Retirement Advantage Landlord Interest Select product, Retirement Advantage's BTL Lifetime Mortgage, share of commissions generate, specialist equity release advisory service

Categorised in: Buy-To-Let Equity Release, Equity Release, Equity Release Referral Partners, Interest Only, Remortgage

This post was written by Mark Gregory