How Retirement Advantage’s Buy-To-Let Equity Release Schemes Can Benefit Your Clients and Your Business

By Mark Gregory on

How James and Sophia helped their grandchildren on to the property ladder by unlocking the wealth in their buy to let property.

In this article we evidence how the new range of Buy-To-Let Equity Release plans launched by Retirement Advantage have helped Equity Release Partners clients to take advantage of the benefits and features they offer. This particular case study shows how by using an existing BTL property, Landlords can release some of the equity tied up within their portfolio to help children, even grandchildren onto the property ladder.

Status: James (75) & Sophia (73) Alexander have owned a buy to let property for 25 years and now the mortgage is fully paid off.

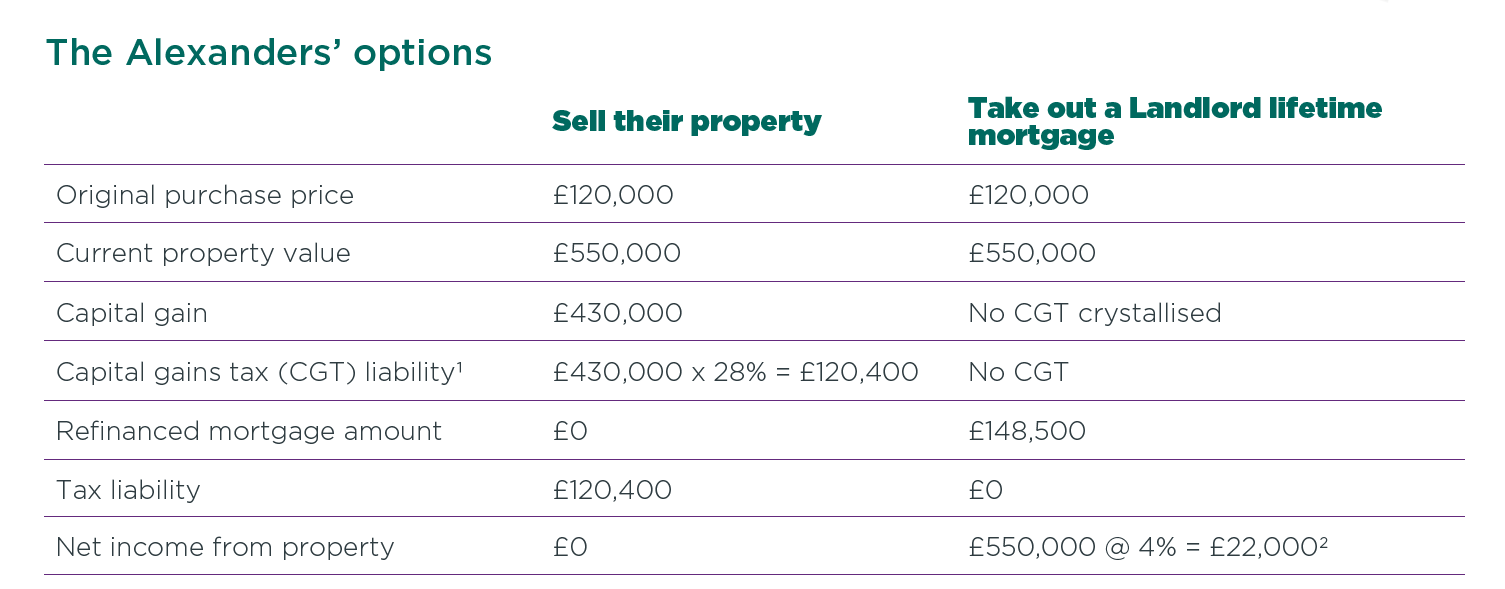

Background: They have 2 grandchildren who they would like to gift some money to, but they wish to keep the property. The property has increased in value from £120,000 in 1992, to £550,000 in 2017.

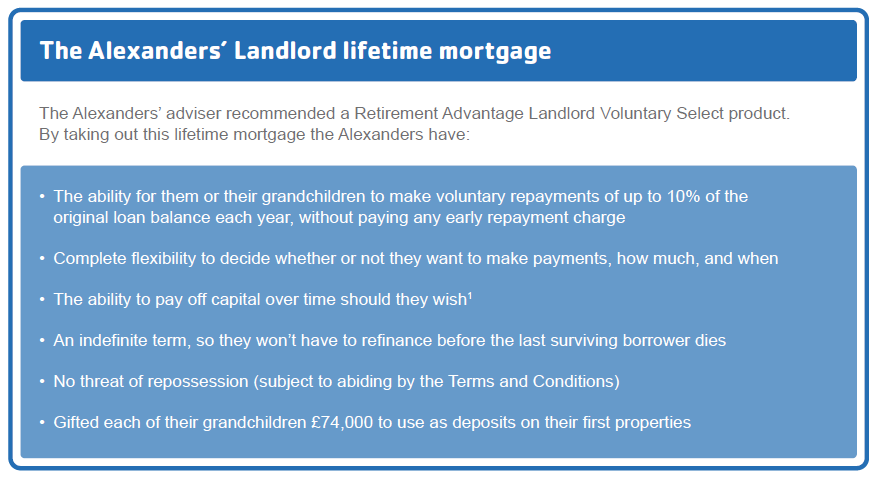

Traditional lenders will not lend to Mr and Mrs Alexander. The grandchildren would like the ability to make payments to reduce the impact of interest roll up, but would like flexibility.Solution: The Alexanders decide to take out a Retirement Advantage Landlord Voluntary Select product.

What the Alexanders achieved

- The Alexanders were able to keep hold of their income generating buy to let property, with no affordability checks or minimum income requirements

- They avoided crystallising a capital gains tax liability of £120,400

- The Alexanders gift each of their two grandchildren £74,000 to get on the property ladder

- They still own an asset which produces in the region of 4% yield (£22,000 per year annually) and they avoided additional selling fees. They may still benefit from future capital gains on the asset (subject to the impact of interest rolling up) and have the flexibility to sell the property and release the remaining equity in future.

The ability for both James and Sophie to be able to access the equity within their buy-to-let property portfolio has been two-fold; tax savings that otherwise they would have lost, plus the benefit of being able to gift down the generations from the success they had achieved from their investment portfolio.

The Retirement Advantage Landlord Voluntary Select product requires equity release permissions in order to be able to provide consumer advice. Therefore, a specialist equity release advisory service such as Equity Release Partners, with a nationwide team of advisers can assist you.

By registering with Equity Release Partners today, you can start referring your clients and taking a share of commissions generated, adding to your profitability and enhancing your service proposition to your database of clients.

Our referral service takes care of the regulatory and compliance requirements. This is complimented by our online portal & case tracking system to ensure both you & your client are kept updated throughout the entire application process.

These cases studies are worked examples and are for illustrative purposes only. Your customers will need to seek their own tax advice and you or your customers should not place any reliance on the figures illustrated in this case study.

1 For simplicity, the CGT calculations assume the following: No stamp duty, purchase or sale costs | No enhancement expenditure | No CGT reliefs are available if property is not sold during the individual’s lifetime, the value of the property will be re-based for CGT purposes on death so inherent capital gain is eliminated. This could enable a gift of the property by whomever inherits to be made tax efficiently.

2 Subject to the customers’ marginal rate of income tax.

3 If the grandchildren repay part or all of their grandparents’ mortgage, there is a risk that the gift with reservation of benefit rules could apply, which

may mean the gift is treated as never having happened for IHT purposes.

To find out more about the range of Retirement Advantage Landlord Options, please call Jane on 0203 291 3007 or visit our Equity Release Comparison tables here – https://equityrelease.partners Tags: BTL property, but to let equity release, buy to let property, Equity Release Comparison tables, Equity Release Partners, equity release permissions, Landlord Voluntary Select, Landlords, property ladder, Retirement Advantage, Retirement Advantage Landlord Options, Retirement Advantage Landlord Voluntary Select, specialist equity release advisory service, traditional lenders

Categorised in: Buy-To-Let Equity Release, Equity Release

This post was written by Mark Gregory